Championing originality

A world without creative constraints. Jaguar is a champion of originality in the arts, exploring exuberant expression through our own creations, and works from a new generation of visionaries.

-

ROYAL COLLEGE OF ART

-

MIAMI ART WEEK

Jaguar x Royal College of Art

Jaguar is proud to partner with London’s Royal College of Art for the Jaguar Arts Award, celebrating emerging visionaries and post graduate students on the RCA renowned MA programmes.

In this opening year, five individual awards will recognise artists whose work embodies our ethos of championing originality. Selected by a panel comprising of RCA alumni, the winning pieces will be showcased in late June.

Jaguar is proud to partner with London’s Royal College of Art for the Jaguar Arts Award, celebrating emerging visionaries and post graduate students on the RCA renowned MA programmes.

In this opening year, five individual awards will recognise artists whose work embodies our ethos of championing originality. Selected by a panel comprising of RCA alumni, the winning pieces will be showcased in late June.

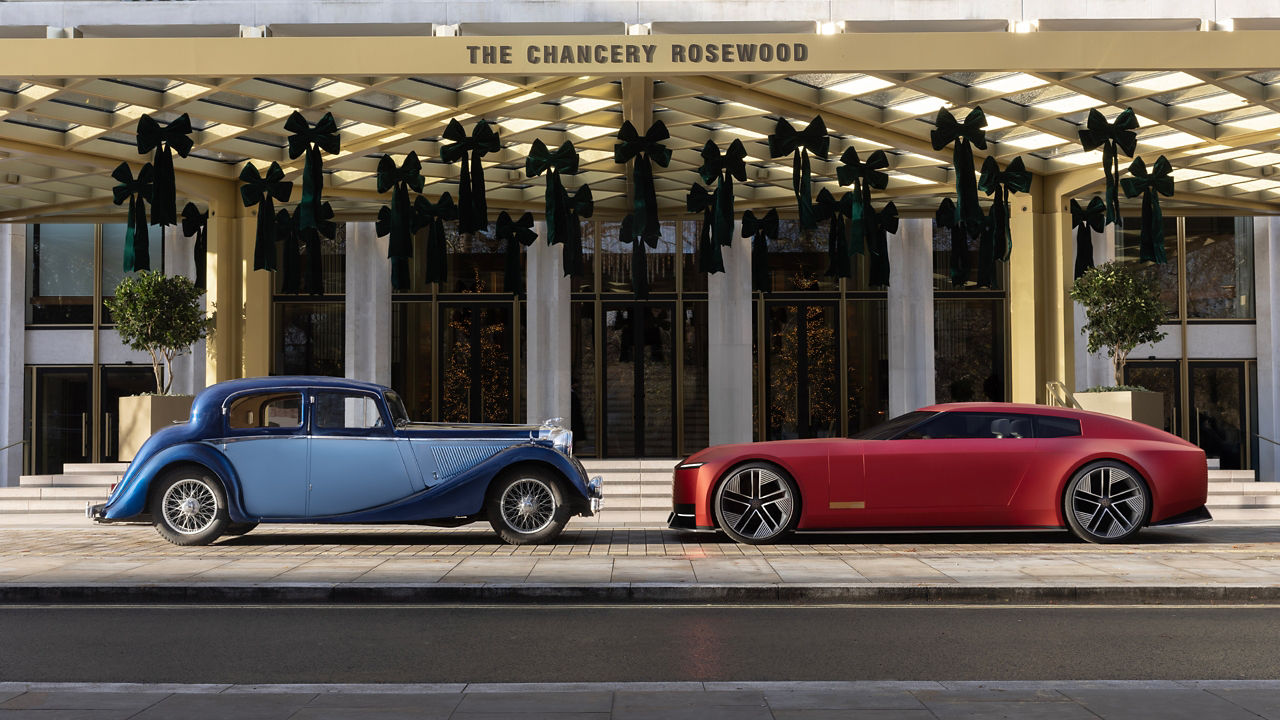

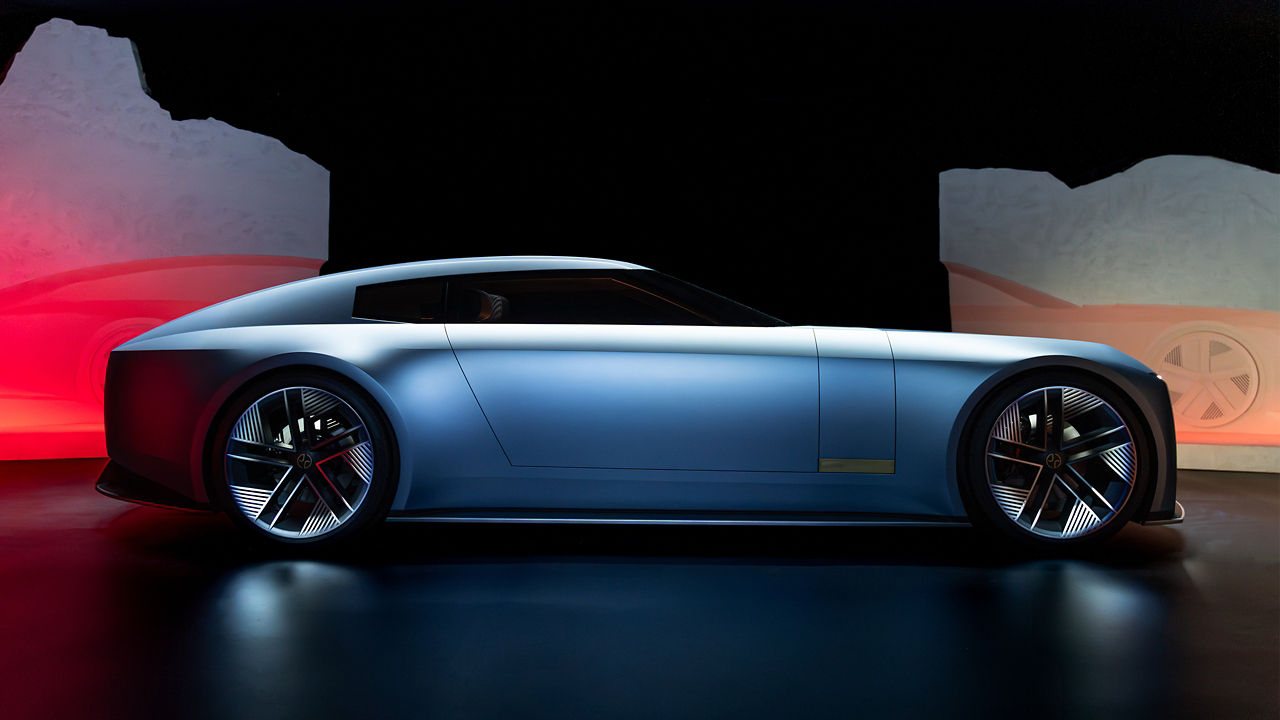

†Jaguar Type 00 is a non-production vehicle